In this blog post, I’ll show you how to find the best CFD broker and start trading today. Discovering a reliable provider is crucial as it will allow you to practice your skills for free before risking any of your capital. To find a great CFD broker, there are some key features that you should look out for.

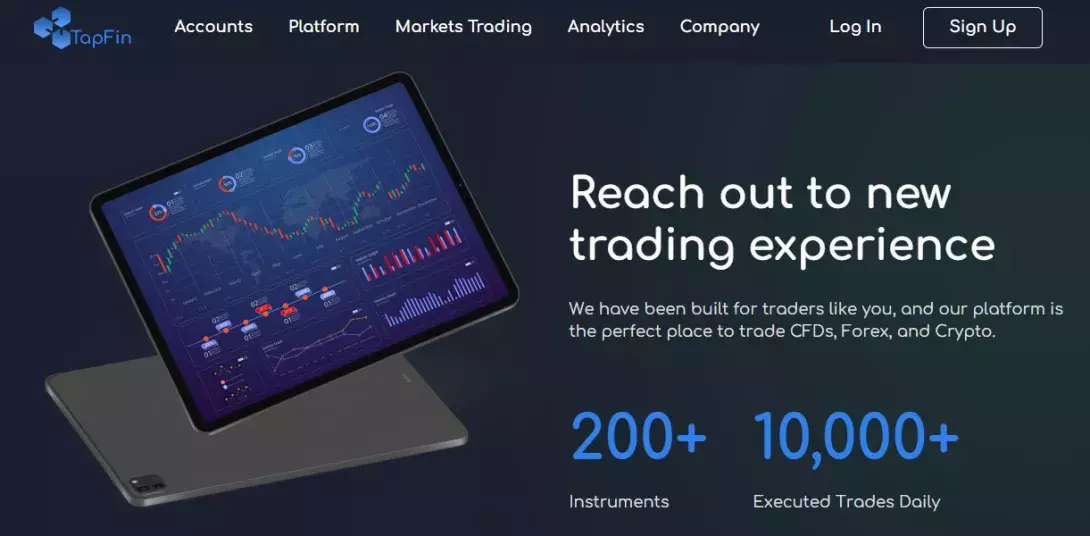

Great Trading Platforms

When it comes to finding the best CFD broker, you need to make sure that the trading platform is up to par. The last thing you want is a platform that is difficult to use or slows down your computer. Look for platforms that are user-friendly and have all of the features you need.

Some brokers offer their trading platforms, while others partner with third-party trading platform providers. It is important to make sure that the platform provider offers a variety of tools and features for both beginners and experienced traders. Be sure to try out the different brokerage platforms for trading CFDs before you decide on a broker. There are many different types of trading platforms available on the market today, including web trading, desktop trading, and mobile trading. Web trading platforms are ideal for traders who want to trade from anywhere in the world, while desktop trading platforms offer more features and tools. Mobile trading platforms are perfect for traders who want to stay connected to the markets 24/11. Test out the speed, ease of use, and features to see which platform is right for you. Remember, you don’t want to be stuck with a platform that you don’t like or that doesn’t meet your needs.

Low Fees

One of the main attractions of CFD trading is the low fees that are associated with it. Most brokers charge a commission on each trade, and this can range from around £0.50 to £20 per trade, depending on the broker you use. Keep in mind that some brokers do charge a withdrawal fee, so be sure to check this before opening an account. Generally, the lower the fees charged by a broker, the better. However, it is important to make sure that the broker you choose offers a wide range of assets and investment products, as well as good customer service. Additionally, there are often no stamp duty charges when trading CFDs. This makes them a much cheaper alternative to buying shares outright.

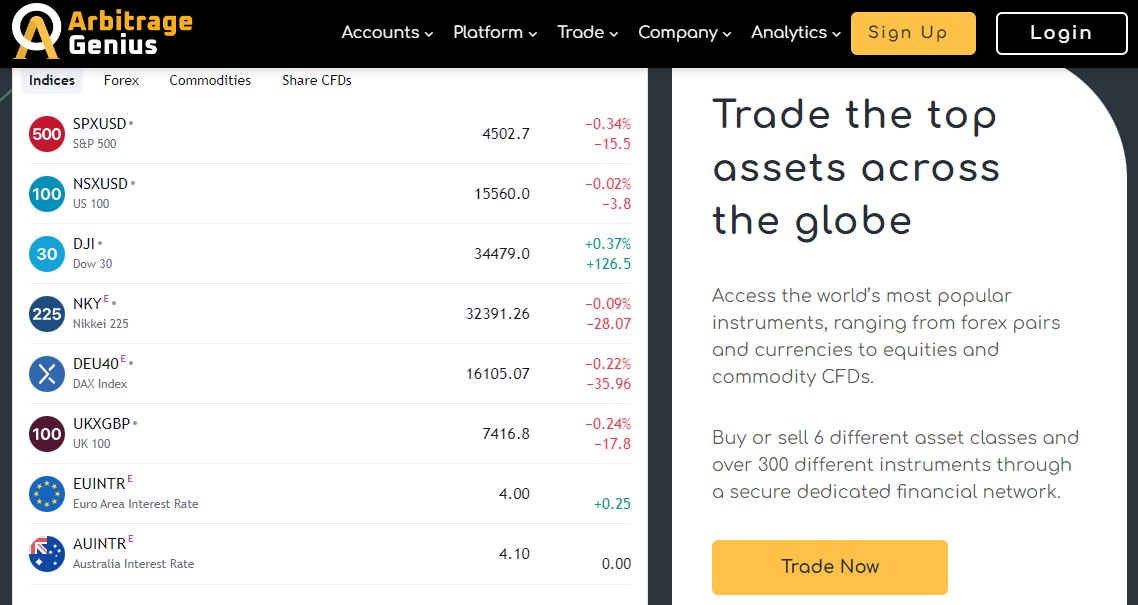

Extensive Market Coverage

CFD Trading provides a trader the opportunity to trade on financial markets that he/she would not be able to otherwise because of their geographic location or lack of access. Some CFD brokers offer trading in indices, commodities, and forex as well as stocks, which means you can use them as your all-in-one platform for trading different asset classes. Additionally, CFD brokers offer a greater degree of market coverage than traditional stockbrokers. For example, most CFD brokers will offer access to markets in the US, Europe, and Asia, which is why they are ideal for traders who want to trade around the clock.

To find the best CFD broker for you, it is important to consider the markets that they offer, as well as their trading platforms and features. Do your research and compare different brokers to find the one that has the markets and features that you need to trade successfully.

Regulation

Regulation of the brokers is also an important factor to consider when choosing a CFD broker. To avoid any risks, it’s highly advised that you choose your broker carefully and find out about its regulation status. The Financial Conduct Authority (FCA) is the UK’s financial regulator. The FCA ensures that all authorized firms conduct their business fairly, honestly, and with integrity. All brokers regulated by the FCA must adhere to a strict code of conduct.

Brokers not regulated by the FCA may not offer the same level of protection for clients. If you’re unsure whether your broker is regulated, contact them directly for clarification. As a result, it’s important to choose your broker based on their regulation status. If you don’t do this and the worst happens – such as unauthorized access of funds or if your investment is lost – then you won’t be able to claim compensation from the FSCS (Financial Services Compensation Scheme).

High Leverage

CFD brokers provide high leverage and margins to their traders. For example, a trader can trade $1000 with only $100 of his own money. The broker will give the trader an extra margin – let’s say 50%. This means that after placing a buy or sell order for one lot (unit) at 100 USD/JPY, the trader will control 200 USD/JPY (100 + 100). If he places an order for one contract at $1000, his total exposure becomes $20 000. This means that if the market moves in favor of the trader by just 0.01% or less than a pip, he gains two times more money compared to not using margin.

On the other hand, if the stock market moves against him by just 0.01%, he will lose twice as much money as he would have without using a margin. Therefore, traders need to understand how high leverage can both increase and decrease their profits and losses when trading CFDs.

Customer Service

The top CFD brokers will have a customer service section on their website where you can find all the contact information for them. This is one of the most important aspects when considering which broker to go with because, unfortunately, there are some bad apples out there that only care about taking your money and giving you nothing in return.

Make sure to check out the reviews of the forex broker on different websites before signing up. The best CFD brokers will have high ratings and positive reviews from their clients. Reading these can give you a good idea about what to expect when working with them. Also, don’t be afraid to ask questions! The customer service representatives should be more than willing to answer any questions you have so that there aren’t surprises later on.

Risk Management

When trading CFDs, it is important to remember to always manage your risk. This means using stops and limits to control how much you can lose on any given trade. It also includes being aware of the risks associated with each commodity or market you trade. For example, bitcoin is a very volatile currency and can experience large price swings in a short period. If you are not comfortable with the risk, it is best to stay away from trading bitcoin CFDs. On the other hand, if you are comfortable with the risks and understand how to manage them, then bitcoin can be a very profitable investment.

The best CFD brokers offer advanced charting software, such as cTrader, eToro, and MetaTrader. Both platforms are designed with traders in mind with all of the necessary functions including sophisticated charts and technical indicators. They also offer a wide range of Risk Management tools so you can control your exposure to the markets. There’s also DAX, which is a sophisticated trading platform for traders who want to trade on derivatives contracts. It’s important that you feel comfortable with the platform before opening an account. Make sure to take advantage of the free demo accounts offered by most brokers so you can test out the software without risking any money.

Once you have found a broker that ticks all of the boxes, it’s time to start trading! But remember, CFDs are complex products and can result in substantial losses if traded recklessly. Always make sure you understand the risks involved before opening an account.