While using algorithmic trading, traders trust their hard-earned money to their trading software. For that reason, the correct piece of computer software is essential to ensure effective and accurate execution of trade orders. On the other hand, faulty software—or one without the required features—may lead to huge losses, especially in the lightning-fast world of algorithmic trading.

What is High Frequency Trading Software for Individuals?

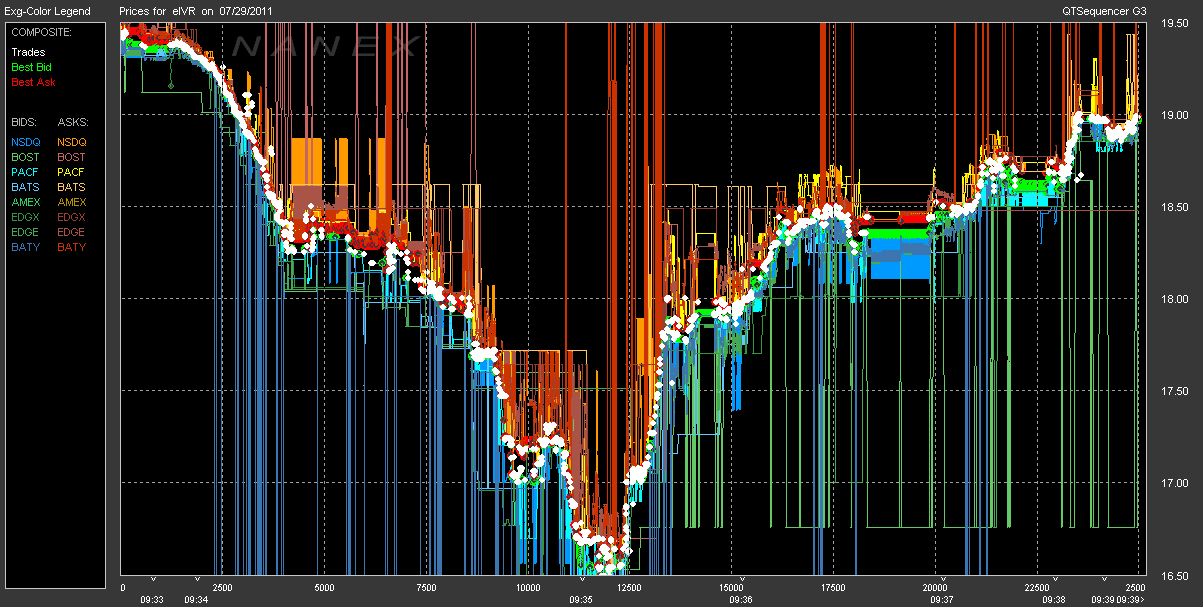

High frequency trading (HFT) refers to the use of computer algorithms and electronic trading systems to automatically enter and exit positions in the financial markets. It focuses on running the algorithm with the shortest period of time, while minimizing the impact of market noise. As a result, a high frequency trading software is an integral part of these types of strategies, as it must instantly react to market information to ensure the most profitable course of action.

Aside from popular trading strategies such as automated trading and black box trading, certain businesses also use high frequency trading software. Take, for example, an individual who is trying to sell their item through an online auction site. This person could program their automatic online bidding software to set a maximum quantity they are willing to pay, and to increase bids above a certain level. A high frequency trading software would find the ideal price to maximize the purchasing price of the item (based on the market price at the time). If the price of the item is right, the software would execute the bid at a lightning-fast pace. Any human intervention can then only lead to an error or a lesser profit.

By employing black box trading strategies, the user of a HFT software executes potentially profitable trades faster than a human trader. The purpose of black box Trading systems is to improve the profits of the trader, while ensuring the maximum placements limits are not reached. This type of trading is considered very profitable.

Pros and Cons of HFT

The goal of using black box trading is to beat the competition, and this usually means those who are trading manually. This process effectively eliminates human error, alerts the user of possible dangers, and can potentially increase profits.

Certain organizations also scam investors through pumps and dumps. Black box trading can protect against these strategies by securely restricting the number of trades or orders you are able to carry out. This will ensure that only the most profitable trades are performed.

At the same time, HFT is the best way to avoid FIFO (first in, first out) taxes. The key part of this strategy is to place an order before the trade opens, and to close the order when the trade closes. This ensures that no shares are held over the weekend, and no taxes are paid on shares owned.

Because of computer technology, you can also use HFT to investigate the best time of the day to make trades. It is quite common for you to provide a list of the specific times you can trade stocks or currencies throughout the week. It is also possible to select specific hours in the day that you can trade stocks or currencies.

Types of High Frequency Trading Software for Individuals

There are two kinds of HFT software for individuals:

Black Box Trading System

The components that comprise a black box Trading system get you to the profits you want. It works automatically through the entire trading process, and it is able to execute trades — even while you are asleep or out of the office — without your intervention.

A black box software automatically detects when new trades are opened, when positions have been closed, and whether a trade contains match or opposite signals. It also connects to the brokerage site automatically, and it does not interfere with your normal trading activities. The best part is that you do not need to know the technicalities behind black box trading.

In addition, black box Trading systems have the ability to trade forex, commodities, stocks, and futures via a single system package. This feature allows you to incorporate multiple financial activities into the automated process.

Automated Invest Bot

Some high frequency trading systems can be connected to your bank account, so that you can simply define certain profit and loss levels to use the financial instrument automatically.

When you define the variable returns or the dates, the automated trading system will identify profitable trading opportunities and places the trades automatically.

Investing Bot is an automated trading software that enables you to be profitable even if you’re not a high frequency trader. To do this, it is essential that you make use of some of the settings that are present within the software to ensure that it will only open or close your trades at the times and under the conditions that you have specified.

Many people are able to exploit the trading system because of the user-friendly interface. Not only is this software ideal for the beginner, but it allows experienced traders to get an edge over the competition.

Why You Must Trust Your High Frequency Trading Software to the Experts

As an individual, you may not be familiar with many of the nuances of a high frequency trading system. However, you also don’t have the time to study and analyze the financial markets outside of your profession. Moreover, it is of critical importance to ensure that your hard-earned funds are secured.

That is why you should trust your high frequency trading system to the professional experts at OST. We’ve been using HFT to build and maintain our own automated trading system for many years. We can assure you that we’ve developed a product that is not only profitable, but also reliable and safe.

At OST, we also offer many different types of commissions to give you maximum return on your investment without certain risks to your assets. These include things such as bounce back, guarantees, and commissions on the purchase roll and reinvestment.

Benefits of High Frequency Trading Software to the Experts

You can utilize the automated trading system to ensure that all financial transactions are completed in a timely, efficient, and accurate manner. This will help you to run a profitable business, save money on taxes, and protect you from scams. As well, the automated trading system works to optimize the bank management process. You can use this software to deposit offline currencies and to transfer assets within your trading account, while you are out of your office.

OTC Securities

This type of stock is referred to as over-the-counter (OTC) security. These trade at more attainable prices in terms of the value of their stock. These invest in the over-the-counter markets because they are easier to find specific securities and more affordable than the traditional exchanges. These are more similar to the traditional exchanges in that they execute trades at a price that varies from the previous market price.

Types of OTC Securities

OTC securities are popular due to their two main categories. The main purpose of both of these types of OTC stocks is to trade the securities of lesser-known financial institutions. These are known as Level II/Level III OTC stocks. This is commonly done through the electronic network OTC Electronic Bulletin Board (OTCBB). Other OTC securities are known as Pink Sheets. These are over-the-counter stocks, and all Securities and Exchange Commission and the New York Stock Exchange alike.

Issues with OTC stocks include the large number of investors who purchase and sell the stock without alerting the proper authorities. Also, the trading of these securities occurs completely independently of the investment banks that are unwarranted by the market.

How to pick the right High Frequency Trading Software for Individuals?

There is an exact amount of steps that you should follow to be able to determine the trading software that is best for you. The steps consist of the following:

Compare the amount it will cost you to utilize the software. You should compare the price of the software with the money that you are willing to invest in the software. You can research the various costs of the software to find out the price before making the purchase.

Compare the cost that you will incur due to the software. You should compare the expenses you are going to incur throughout the year with the cost of the software. For example, you can compare the price of the software with the price of the internet connection that you will need to use the software. This is a way of finding out how much the software is going to cost you.

Compare the cost of purchasing and maintaining the software. You should compare the cost of purchasing and supporting the software over the years of your future trading career. This is another way you can be able to find out how much it is going to cost you to purchase the software.

Compare the cost of purchasing software with the maintenance costs and the costs of purchasing software. You should compare the cost of purchasing software and the cost of maintaining the software. This is a way of determining how much the software is going to cost you to purchase the software and the maintenance costs.

Compare the cost of purchasing software with the costs of the maintenance costs plus the cost of maintaining the software. With this cost comparison, you should compare the cost of maintaining the software with the cost of maintaining the software. This is a way of determining how much the costs are going to be so that you can purchase the software and the maintenance costs.

Compare the cost of choosing software with the maintenance costs plus the cost of maintaining the software. This is a way of determining how much the cost of maintaining the software is going to be. Then compare it with the cost of maintaining the software plus the potential costs of the software. This will help you to find out how many costs you will be incurring plus the cost of the software and the cost of the software.

Compare the costs of the maintenance costs plus the cost of maintaining the software with the cost of choosing the software. This will help you to find out how many costs you will be incurring. You can then compare it with the cost of buying and keeping the software. This will help you to find out how many expenses you will be incurring.

Compare the total costs for choosing and maintaining the software. This will help you to find out how many expenses you will be incurring. Then compare the total expenses plus the cost of the software to the cost of buying and keeping the software. This will help you to find out how much the software is going to cost you.

Compare the cost of purchasing software with the total cost of the software and the maintenance costs plus the cost of choosing the software and the maintenance cost. This will help you to find out how many expenses you will be incurring. Then compare this total expense with the total expense of software costs and maintenance costs. This will help you to find out how much the software is going to cost you.

Compare the total costs of choosing and maintaining the software with the total cost of the software and the purchase and maintenance costs. This is a way of determining how much the software is going to cost you. Then, you can compare the total expenses incurred with the cost of the software and the cost of the software. This will help you to find out how much it will cost you.

Compare the total cost of the software of the total costs of maintaining the software with the cost of the software. This will help you to find out how much it will cost you. Then, compare this figure with the cost of the software maintenance costs. This will help you to find out how much it will cost you.

Compare the cost of determining whether or not the software will be stable through testing. You should compare the cost of determining whether or not the software will be stable by testing it to the costs of determining whether or not the software will be stable. This will help you to find out what it will cost you.

Compare the cost of determining whether or not the software is stable with the cost of determining whether or not the software is stable. This will help you to find out what it will cost you.

Compare the amount of maintenance costs you are going to incur throughout your trading career with the amount of maintenance costs you are going to incur throughout your trading career. You should compare the amount of maintenance costs you are going to incur throughout your trading career with the amount of maintenance costs you are going to incur throughout your trading career. This will help you to find out how much money you will be incurring in your lifetime due to the cost of maintenance.

Compare the amount of maintenance costs that you are going to incur throughout your trading career with the cost of determining whether or not the software is stable. You should compare the amount of maintenance costs that you are going to incur throughout your trading career with the amount of maintenance costs you are going to incur throughout your trading career. This will help you to find out what it will cost you.

Compare the amount of maintenance costs you are going to incur throughout your trading career with the cost of determining whether or not the software is stable. You should compare the amount of maintenance costs that you are going to incur throughout your trading career with the amount of maintenance costs that you are going to incur throughout your trading career. This will help you to find out what it will cost you.

Compare the amount of money you are going to spend throughout your trading career with the cost of determining whether or not the software is stable. You should compare the amount of money you are going to spend throughout your trading career with the amount of money you are going to spend throughout your trading career. This will help you to find out what it will cost you.

Compare the amount of money you are going to spend throughout your trading career with the cost of determining whether or not the software is stable. You should compare the amount of money you are going to spend throughout your trading career with the amount of money you are going to spend throughout your trading career. This will help you to find out what it will cost you.

Compare the amount of average money you will be spending throughout your trading career with the cost of determining whether or not the software is stable. You should compare the amount of average money you will be spending throughout your trading career with the amount of average money you will be spending throughout your trading career. This will help you to find out what it will cost you.

Compare the amount of money you are going to spend throughout your trading career with the cost of determining whether or not the software is stable. You should compare the amount of money you are going to spend throughout your trading career with the amount of average money you will be spending throughout your trading career. This will help you to find out what it will cost you.