People suggest that it’s more convenient to apply to alternative lending solutions today rather than conventional banks. While banks have strict eligibility criteria and prefer to deal with good credit holders, payday lending options offer short-term financial assistance to low-income consumers with poor or no credit at all.

They seem to be a fast and suitable option, but they might also trap you into a debt cycle if you fail to follow the rules. Keep on reading to find out about the pros and cons of payday loans, as an alternative to the local banks.

How Payday Loans Work

The payday lending option differs from taking out extra funds from the local bank. You can use PayDaySay emergency loans – a borrowing solution that offers from $100 to $5,000 for the period of two to three weeks that should be returned in a lump payment on the next salary day.

This option is suitable for covering various near-term money needs. Do you need to cover a money crunch? Taking out a payday lending option will take a few minutes and the funds can be deposited into the borrower’s bank account within 24 or 48 business hours.

This solution doesn’t have strict eligibility criteria compared to the local banks. Even consumers with poor or no credit may easily apply and get approved for a small sum. At the same time, traditional lending companies want to make sure a client has enough means to return the money on time.

So, banks often ask to submit multiple papers and application documents to get qualified. These crediting institutions are more eager to deal with applicants who seek long-term financial aid.

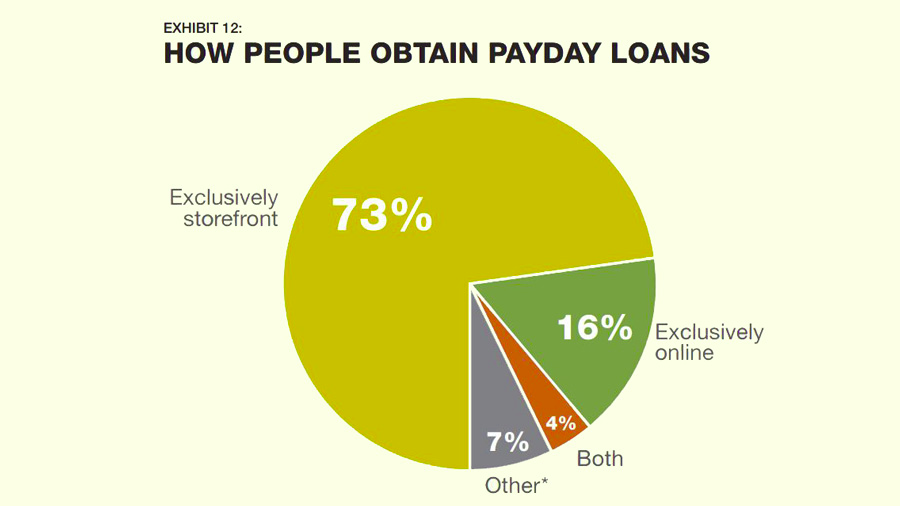

source: pewtrusts.org

Why Are Payday Loans Widespread?

Payday lending is a useful solution for situations when you are short of cash but don’t need a big amount of money. Generally, borrowers opt for this decision to:

- finance a big-ticket purchase;

- fund urgent medical bills;

- get extra cash until the next payday;

- cover overdue bills and utility payments;

- finance a vacation;

- cover wedding costs.

This solution isn’t meant to assist with big sums and long-term solutions. You can apply for it to obtain a few hundred dollars for a couple of weeks (generally until the next salary day).

Pros of Payday Lending

When a borrower experiences some financial inconveniences and wants to choose payday lending, here are several advantages of this decision:

- Instant Cash – this is a hassle-free solution for the times when you are short of cash and value your time. Forget about the tedious application process at conventional banks. You won’t need to submit any documents to apply for payday lending options. The cash is acquired almost instantly.

- A Wide Network of Creditors – You don’t need to submit a separate loan request to each lender. Payday lending services deal with a large database of direct creditors in almost every state.

So, even if you’ve been rejected by banks, you can try your luck through online lending platforms and companies.

- Quick Decision – while your landlord won’t wait too long, the late bills will pile up, and health issues can’t be put off, you can apply for a payday loan.

This borrowing option will support you until you receive the next salary. You don’t need to feel stressed out when everything is closed over the weekend. Online alternative lenders work 24/7 for your convenience.

- Same Day Funding for Any Purpose – Traditional banks need to check and verify numerous documents but alternative lenders will only verify your basic personal and financial information.

The funding is quick and secure. No paperwork or faxing is needed to obtain quick money. Creditors never ask about your purpose so the funds may be utilized for various needs

Cons of Payday Lending

- High-Interest Rates – Compared to the bank requirement and lending offers, payday lending is much more expensive. Be prepared to pay the average APR from 391% to 500% for a small loan. Banks that offer personal loans charge between 4% and 36% in interest.

- Predatory Solution – many people call payday loans predatory as they charge sky-high fees and additional charges such as prepayment fees, origination fees, late charges, etc.

The creditor doesn’t check your credit history so they want to eliminate risks of default. Offering a chance to obtain extra cash to low-income consumers and clients with no credit, payday loans become a dangerous tool if you fail to repay the debt on time.

- It Doesn’t Help Your Credit – if your credit is poor or you don’t have credit at all, you may want to look for borrowing options that will help you build your credit. Unfortunately, the payday lending option isn’t suitable for this purpose. The service providers don’t report your payments to the three major credit agencies so your credit won’t get a chance to boost.

Is Payday Loan a Good Bank Alternative?

As you can see, the payday lending option has its pros and cons similar to other crediting solutions. Payday loans have gained popularity over the last decade.

The reason for that is the growing number of financial disruptions in people of all ages. The financial crisis in many countries as well as in the USA means borrowers need to search for different ways to get extra financial assistance.

Many applicants live from paycheck to paycheck and can’t afford to pay even $400 of unforeseen expenditures. It means the majority of consumers don’t have an emergency to help them live through a monetary shortfall.

So, getting a payday lending solution seems like a reasonable decision provided that you understand all the requirements and terms before you sign an agreement. It can be a smart decision if you just need a small sum for the short term.